The current due date for mortgage payment vacation applications, which allow property owners to defer payments for approximately six months, is 31 January 2021. You can learn more with the following articles: For the current updates and recommendations, go to the Which? coronavirus info center. Choosing the ideal type of home mortgage could conserve you thousands of pounds, so it's really essential to comprehend how they work.

This rate can be repaired (guaranteed not to alter) or variable (might increase or decrease). Watch our short video below for a fast explanation of each different type of home mortgage and how they work. We explain them in more detail further down the page. Listed below, you can learn how each home loan type works, then compare Go here the advantages and disadvantages of fixed-rate, tracker and discount rate home mortgages in our table.

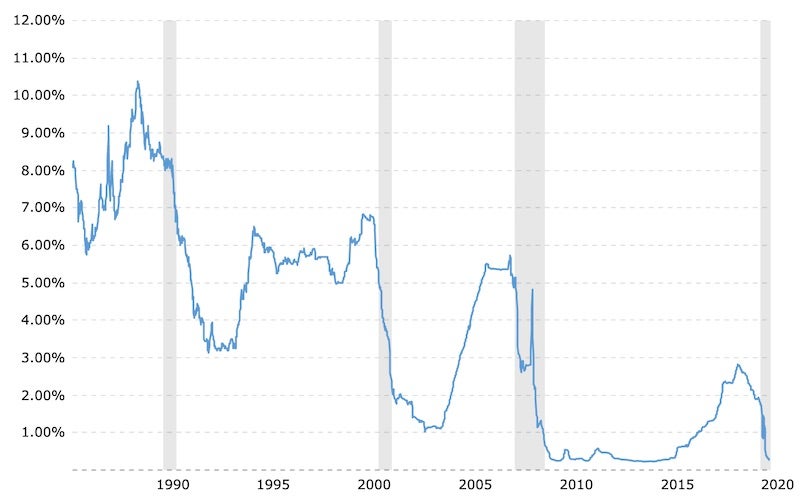

With a tracker home loan, your rate of interest 'tracks' the Bank of England base rate (currently 0. how is the compounding period on most mortgages calculated. 1%) for example, you may pay the base rate plus 3% (3. 1%). In the current mortgage market, you 'd generally get a tracker home mortgage with an initial offer period (for example, 2 years).

Nevertheless, there are a small number of 'lifetime' trackers where your mortgage rate will track the Bank of England base rate for the entire home mortgage term. When we surveyed home mortgage consumers in September 2019, one in 10 stated they had tracker home mortgages. With a discount mortgage, you pay the loan provider's basic variable rate (a rate chosen by the loan provider that doesn't change extremely often), with a repaired amount discounted.

5% discount rate, you 'd pay 2. 5%. Discounted deals can be 'stepped'; for instance, you may get a three-year deal however pay one rate for 6 months and then a greater rate for the remaining two-and-a-half years. Some variable rates have a 'collar' a rate listed below which they can't fall or are capped at a rate that they can't go above.

Some Known Factual Statements About What Is The Enhanced Relief Program Click here for more info For Mortgages

Some 5% of those we surveyed in 2019 stated they had discount home loans. With fixed-rate mortgages, you pay the exact same rates of interest for the entire deal period, regardless of interest rate modifications somewhere else. 2- and five-year offer durations are the most common, and when you reach the end of your set term you'll generally be proceeded to your lending institution's standard variable rate (SVR).

Fixed-rate home mortgages were the most popular in our 2019 home loans survey, with 6 in 10 saying they had one. Five-year offers were the most popular, followed by two-year offers. Each lender has its own basic variable rate (SVR) that it can set at whatever level it wants implying that it's not directly linked to the Bank of England base rate.

72%, according to Moneyfacts. This is higher than most mortgage offers currently on the market, so if you're presently on an SVR, it deserves going shopping around for a brand-new home loan. Lenders can change their SVR at any time, so if you're currently on an SVR home mortgage, your payments might potentially go up - specifically if there are rumours of the Bank of England base rate increasing in the future - what beyoncé and these billionaires have in common: massive mortgages.

The majority of these had had their mortgages for more than five years. Advantages and disadvantages of different mortgage types Throughout the offer duration, your rate of interest won't increase, no matter what's taking place to the broader market - after my second mortgages 6 month grace period then what. A good option for those on a tight budget plan who want the stability of a fixed month-to-month payment.

2. 9% If the base rate goes down, your regular monthly repayments will usually drop too (unless your deal has a collar set at the existing rate). Your rate of interest is only impacted by changes in the Bank of England base rate, not changes to your lender's SVR. You will not understand for specific how much your repayments are going to be throughout the deal period.

Some Of Why Is There A Tax On Mortgages In Florida?

2. 47% Your rate will remain listed below your loan provider's SVR for the period of the offer. When SVRs are low, your discount home loan might have a really cheap rate of interest. Your loan provider could change their SVR at any time, so your payments could end up being more expensive. 2. 84% * Typical rates according to Moneyfacts.

Whether you should opt for a repaired or variable-rate mortgage will depend on whether: You believe your income is likely to change You choose to understand precisely what you'll be paying every month You might manage if your monthly payments went up When you secure a home loan it will either be an interest-free or payment mortgage, although sometimes people can have a combination.

With a payment mortgage, which is without a doubt the more common type of mortgage, you'll pay off a little the loan as well as some interest as part of each monthly payment. In some cases your scenarios will imply that you need a particular kind of home loan. Types of specialist mortgage could consist of: Bad credit home loans: if you have black marks on your credit history, there might still be mortgages available to you - but not from every loan provider.

Guarantor mortgages: if you require aid getting onto the home ladder, a parent or member of the family might ensure your loan. Flexible home mortgages let you over and underpay, take payment holidays and make lump-sum withdrawals. This implies you could pay your home mortgage off early and conserve on interest. You don't generally have to have a special home mortgage to overpay, though; lots of 'normal' deals will likewise allow you to settle additional, up to a certain quantity normally as much as 10% each year.

Versatile deals can be more pricey than traditional ones, so make sure you will really utilize their functions before taking one out. Some home loan deals offer you cash back when you take them out. However while the expenses of moving can make a wad of cash noise extremely appealing, these deals aren't constantly the cheapest as soon as you have actually factored in fees and interest.

The 5-Second Trick For How Many Mortgages In One Fannie Mae

When I was a little girl, there were three home loan types readily available to a house purchaser. Buyers might get a fixed-rate standard mortgage, an FHA loan, or a VA loan. Times have actually definitely changed. Now there are an excessive variety of mortgage types available-- as the stating goes: more home mortgage loan types than you can shake a stick at! This is the granddaddy of them all.

FHA mortgage loan types are guaranteed by the government through home mortgage insurance coverage that is moneyed into the loan. First-time property buyers are ideal candidates for an FHA loan because the down https://telegra.ph/the-25second-trick-for-what-do-i-need-to-know-about-mortgages-and-rates-01-01 payment requirements are minimal and FICO ratings do not matter. The VA loan is a federal government loan is offered to veterans who have actually served in the U.S.

The requirements vary depending upon the year of service and whether the discharge was honorable or unethical. The primary advantage of a VA loan is the borrower does not need a down payment. The loan is guaranteed by the Department of Veterans Affairs but funded by a traditional lending institution. USDA loans are offered through the U.S.